“Compliance is always going to be out on the forefront as one of the higher expense items, followed by technology.”

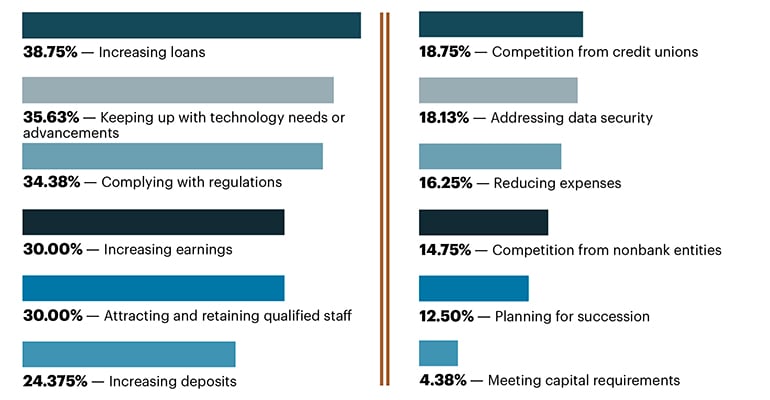

With this statement, Kathy Sutherland, President, and CEO of Durand State Bank expressed the concern of many community banks: regulatory compliance, while important, is particularly costly. Compliance consistently scores high on the priority lists of local banks. According to a CEO survey by Independent Banker, complying with regulations is a top-three concern for over 34% of community bank CEOs.

The good news for these banks is that new technology, Robotic Process Automation (RPA), excels at automating compliance processes. Roberto Valdez of Kaufman Rossin stated, “RPA in banking can offer three benefits: efficiency, effectiveness, and compliance.” According to Valdez, automation helps lower costs, provides greater consistency in execution, and ultimately helps banks comply with federal and state regulations.

So what are some specific use cases of the kinds of compliance opportunities that RPA can be used for?

The top three priorities from the Independent Banker CEO Outlook survey shows compliance and tech costs near the top.

Opening Accounts and Know Your Customer (KYC) Checks

Opening accounts, combined with KYC requirements, is a great example of using RPA to help on two fronts: increasing deposits and reducing the costs of compliance. RPA is particularly helpful in checking external sources of information, such as the Office of Foreign Assets Control and identity check lists for individuals and corporate entities.

HMDA Reporting

The Home Mortgage Disclosure Act (HMDA), implemented in Regulation C, requires reporting loan-level information about mortgages. Community banks in particular find HMDA compliance particularly costly, since residential loans can easily make up a majority of a bank’s loan portfolio. For example, residential mortgages make up 79% of the loan portfolio of Northview Bank in Finlayson, Minnesota. The bank hired a full-time employee to meet the requirements of TRID and HDMA. RPA can ease this regulatory burden significantly.

Regulation E dispute Resolution

Of course, Regulation E governs the rights and responsibilities for electronic funds transfer (EFR) transactions. A good place to start with Reg E automation is Section 205.11, procedures for resolving errors. Manual processes are subject to costly errors. For example, when a dispute is reported, the steps to initiate an investigation may be missed. In addition, an investigation involves pulling relevant bank statements and reviewing transactions. The speed, consistency, and accuracy of RPA helps a bank to complete an investigation in a timely manner.

Balancing Technology Costs and Compliance Improvements

A Tata Consultancy Services paper touts RPA for, “…its ability to perform routine compliance tasks faster and more accurately than human resources”. To realize these RPA benefits, community banks need to determine which types of technology spending can reduce costs.

Jason Chorlins of Kaufman Rossin summed up the catch-22 of technology and RPA in banking compliance: there is a, “…tension between the additional investment needed to implement RPA and the day-to-day reality of needing to keep up with regulatory and compliance issues. Yet these are both areas where community banks could see improvement through the use of RPA.”

Deloitte recommends performing a cost-benefit analysis to determine which projects offer the greatest return. See this post for more information on getting started with RPA, cost-effectively.